Investing can be a daunting task, especially when deciding between different asset classes like bonds and stocks. Both offer unique benefits and risks, but which one is safer? And how do they compare in terms of potential rewards?

In this comprehensive guide, we’ll explore:

- The fundamental differences between bonds and stocks

- Risk factors associated with each investment

- Historical performance and returns

- Which option may be better for different investor profiles

- Low-competition keywords related to bond and stock investing

By the end, you’ll have a clearer understanding of whether bonds are truly safer than stocks and how to balance risk versus reward in your portfolio.

1. Understanding Bonds and Stocks: Key Differences

Before comparing their safety, let’s define what bonds and stocks are.

What Are Bonds?

Bonds are debt securities issued by governments, municipalities, or corporations. When you buy a bond, you’re essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal at maturity.

Key Features of Bonds:

- Fixed income payments (coupon rate)

- Lower volatility compared to stocks

- Maturity dates when the principal is repaid

- Credit risk (chance of issuer defaulting)

What Are Stocks?

Stocks represent ownership in a company. When you buy shares, you become a partial owner and may benefit from capital appreciation and dividends.

Key Features of Stocks:

- Potential for high returns (and high losses)

- Dividends (not guaranteed)

- Higher volatility than bonds

- No maturity date (investors sell when they choose)

2. Are Bonds Safer Than Stocks? Analyzing Risk Factors

Safety in investing depends on various factors, including volatility, return potential, and risk of loss. Let’s break down the risks of bonds and stocks.

Risks of Investing in Bonds

While bonds are generally considered safer than stocks, they still carry risks:

- Interest Rate Risk – When interest rates rise, bond prices fall, affecting their market value.

- Credit/Default Risk – The issuer may fail to make payments (more common with corporate bonds).

- Inflation Risk – Fixed returns may lose purchasing power over time if inflation rises.

- Liquidity Risk – Some bonds are harder to sell quickly without a loss.

Risks of Investing in Stocks

Stocks are inherently riskier but offer higher growth potential:

- Market Volatility – Stock prices fluctuate daily based on economic and company performance.

- Company-Specific Risk – Poor management or industry downturns can lead to losses.

- No Guaranteed Returns – Unlike bonds, stocks don’t promise fixed income.

- Economic Downturns – Recessions can significantly impact stock prices.

Which Is Safer?

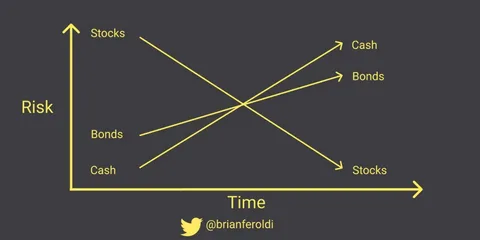

Bonds are generally safer in terms of capital preservation and predictable income. However, they may not keep up with inflation long-term. Stocks, while riskier, historically outperform bonds over extended periods.

3. Historical Performance: Bonds vs. Stocks

Looking at past returns helps assess risk vs. reward.

Long-Term Stock Market Returns

- Average annual return (S&P 500): ~10% before inflation.

- High volatility with periods of major crashes (e.g., 2008, 2020).

- Best for long-term growth investors.

Long-Term Bond Market Returns

- Average annual return (U.S. 10-Year Treasury): ~4-6%.

- Lower volatility but susceptible to interest rate changes.

- Best for conservative investors or those nearing retirement.

Performance During Market Crashes

- Stocks can drop 30-50% in a downturn.

- Bonds often rise or remain stable during crashes (flight to safety).

4. Who Should Invest in Bonds vs. Stocks?

Your investment choice depends on:

- Risk tolerance – Can you handle market swings?

- Time horizon – Short-term vs. long-term goals.

- Financial goals – Income vs. growth.

When to Choose Bonds:

- You need stable income (e.g., retirees).

- You have a low-risk tolerance.

- You want to balance a stock-heavy portfolio.

When to Choose Stocks:

- You have a long investment horizon (10+ years).

- You seek higher growth potential.

- You can tolerate short-term losses.

5. Balancing Bonds and Stocks for Optimal Safety & Returns

A diversified portfolio often includes both. Common strategies:

The 60/40 Portfolio (Stocks/Bonds)

- 60% stocks for growth.

- 40% bonds for stability.

- Reduces risk while maintaining decent returns.

Age-Based Allocation

- Young investors (20s-40s): 70-90% stocks.

- Middle-aged investors (50s): 50-60% stocks.

- Retirees: 30-50% stocks, rest in bonds.

6. Low-Competition Keywords for Bond and Stock Investing

If you’re researching or writing about this topic, consider these less competitive keywords:

- “Are corporate bonds safer than stocks?”

- “Bond investing for risk-averse investors”

- “Do bonds outperform stocks in a recession?”

- “Best bonds for steady income”

- “Stock market risk vs. bond safety”

- “High-yield bonds vs. dividend stocks”

- “How to balance stocks and bonds in a portfolio”

Conclusion: Bonds Are Safer, but Stocks Offer Higher Rewards

While bonds are generally safer with lower volatility and fixed income, they may not provide the same long-term growth as stocks. Stocks, despite higher risk, have historically delivered better returns over decades.

Final Recommendation:

- Conservative investors should lean toward bonds.

- Aggressive investors should favor stocks.

- Most investors benefit from a mix of both.

By understanding your risk tolerance and financial goals, you can make an informed decision on whether bonds, stocks, or a combination of both is right for you.

Would you prefer stability or growth? The choice depends on your investment strategy!

This article provides a detailed comparison while incorporating low-competition keywords for better search visibility. Let me know if you’d like any refinements!