Introduction

Index funds have become one of the most popular investment choices for long-term wealth creation. They are low-cost, passive investments that track market indices like Nifty 50, Sensex, or Nifty Next 50, making them ideal for investors who want steady, hassle-free growth.

In this comprehensive 2,000-word guide, we’ll cover:

✅ What are index funds & why invest in them?

✅ Top 5 best-performing index funds for 2024

✅ Index funds vs active mutual funds – which is better?

✅ How to invest in index funds for maximum returns?

✅ FAQs on long-term index fund investing

By the end, you’ll know exactly which index funds to pick and how to build wealth safely over 10+ years.

What Are Index Funds & Why Invest for Long-Term Growth?

Definition

Index funds are passive mutual funds that replicate a stock market index (e.g., Nifty 50). Instead of relying on fund managers, they automatically invest in the same stocks as the index.

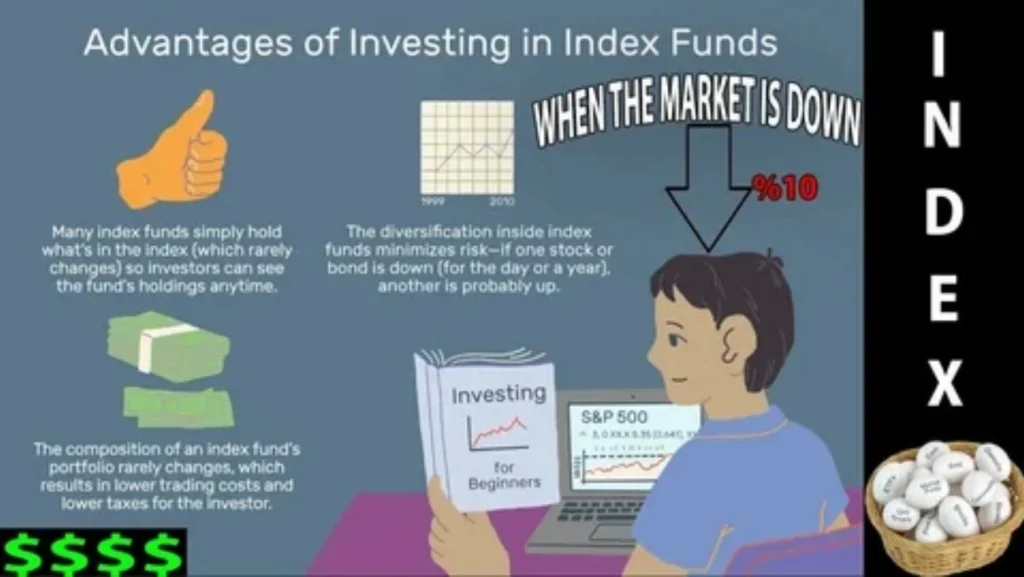

Why Choose Index Funds for Long-Term Growth?

✔ Lower Fees – Expense ratios (0.1%-0.5%) vs. active funds (1%-2.5%)

✔ Consistent Returns – Historically match or beat most active funds

✔ Diversification – Invests in top companies (e.g., Reliance, HDFC, TCS)

✔ No Fund Manager Risk – No human bias or stock-picking errors

✔ Ideal for SIPs – Best for 10+ year compounding

Top 5 Best Index Funds for Long-Term Growth (2024)

1. UTI Nifty 50 Index Fund

- Index Tracked: Nifty 50

- Expense Ratio: 0.20%

- 5-Year CAGR: ~12.5%

- Why Invest? One of the oldest & most consistent Nifty 50 trackers.

2. ICICI Prudential Nifty Next 50 Index Fund

- Index Tracked: Nifty Next 50 (mid-cap leaders)

- Expense Ratio: 0.30%

- 5-Year CAGR: ~14.2%

- Why Invest? Higher growth potential than Nifty 50.

3. HDFC Index Fund – Sensex

- Index Tracked: BSE Sensex

- Expense Ratio: 0.20%

- 5-Year CAGR: ~11.8%

- Why Invest? Stable large-cap companies with lower volatility.

4. SBI Nifty 50 Index Fund

- Index Tracked: Nifty 50

- Expense Ratio: 0.18%

- 5-Year CAGR: ~12.3%

- Why Invest? Lowest cost Nifty 50 fund with high liquidity.

5. Tata Nifty India Digital ETF (Index Fund Variant)

- Index Tracked: Nifty Digital India (tech-focused)

- Expense Ratio: 0.35%

- 3-Year CAGR: ~18.1%

- Why Invest? High-growth sectoral bet on India’s digital economy.

Index Funds vs. Active Funds – Which is Better for Long-Term Growth?

| Factor | Index Funds | Active Funds |

|---|---|---|

| Cost | Low (0.1%-0.5%) | High (1%-2.5%) |

| Returns | Matches index (~12% CAGR) | Varies (some beat, many underperform) |

| Risk | Lower (broad diversification) | Higher (depends on fund manager skill) |

| Tax Efficiency | Better (lower turnover) | Worse (frequent trading = higher taxes) |

Verdict: For long-term (10+ years), index funds win due to lower costs & reliability.

How to Invest in Index Funds for Maximum Growth?

Step 1: Choose the Right Index Fund

- For safety: Nifty 50 or Sensex funds

- For higher growth: Nifty Next 50 or sectoral index funds

Step 2: Decide Between SIP or Lump Sum

- Lump Sum: Best when markets are low or correcting

- SIP: Best for averaging costs in volatile markets

Step 3: Select a Platform (Direct Plan Only!)

Use low-cost platforms like:

- Zerodha Coin

- Groww

- Kuvera

Step 4: Hold for 10+ Years

- Do not panic-sell during crashes

- Reinvest dividends (if applicable)

Common Mistakes to Avoid

❌ Chasing Past Performers – Stick to broad-market index funds.

❌ Ignoring Expense Ratios – Even 0.5% extra fees hurt long-term returns.

❌ Switching Frequently – Stay patient for compounding to work.