Introduction to Investment Trusts

Investment trusts are a popular way for investors to gain exposure to a diversified portfolio of assets without having to pick individual stocks. Unlike open-ended funds, investment trusts are closed-ended, meaning they have a fixed number of shares traded on stock exchanges. This structure allows them to take a long-term approach, often using leverage to enhance returns.

For beginners, investment trusts can be an excellent entry point into the world of investing. They offer professional management, diversification, and often pay dividends. In this guide, we’ll explore the best starter picks in the UK and US, along with key factors to consider before investing.

Why Choose Investment Trusts?

Before diving into specific picks, let’s look at why investment trusts stand out:

1. Discounts & Premiums to NAV

Investment trusts trade at prices that can be higher (premium) or lower (discount) than their net asset value (NAV). Savvy investors can take advantage of discounts to buy assets for less than their underlying worth.

2. Income & Dividend Reserves

Many UK investment trusts have revenue reserves, allowing them to smooth dividend payouts even in tough market conditions—making them attractive for income seekers.

3. Long-Term Performance

With a fixed pool of capital, managers can focus on long-term growth without worrying about short-term redemptions.

4. Access to Niche Markets

Some trusts specialize in sectors like private equity, infrastructure, or emerging markets, offering exposure that’s hard to get elsewhere.

Best UK Investment Trusts for Beginners

Here are some top UK-listed investment trusts ideal for new investors:

1. Scottish Mortgage Investment Trust (SMT)

- Focus: Global growth stocks (tech, biotech, disruptive innovation)

- Why Invest? Backed by Baillie Gifford, SMT holds high-growth companies like Tesla, ASML, and Moderna. It’s a high-risk, high-reward play but has a strong long-term track record.

- Dividend Yield: ~0.5% (Growth-focused, not high-income)

- Keyword: Best UK growth investment trust

2. City of London Investment Trust (CTY)

- Focus: UK dividend stocks

- Why Invest? Managed by Janus Henderson, CTY has increased its dividend for over 50 years, making it a top choice for income investors.

- Dividend Yield: ~5%

- Keyword: Best UK dividend investment trust

3. F&C Investment Trust (FCIT)

- Focus: Global diversified equities

- Why Invest? One of the oldest trusts (founded in 1868), FCIT offers broad global exposure with a solid performance history.

- Dividend Yield: ~1.5%

- Keyword: Best long-term UK investment trust

4. Greencoat UK Wind (UKW)

- Focus: Renewable energy infrastructure

- Why Invest? Provides stable, inflation-linked returns from wind farms. Ideal for ESG-focused investors.

- Dividend Yield: ~5.5%

- Keyword: Best renewable energy investment trust UK

5. BlackRock World Mining Trust (BRWM)

- Focus: Mining & commodities

- Why Invest? Offers exposure to global mining giants like BHP and Rio Tinto, benefiting from commodity cycles.

- Dividend Yield: ~4.5%

- Keyword: Best commodities investment trust UK

Best US Investment Trusts for Beginners

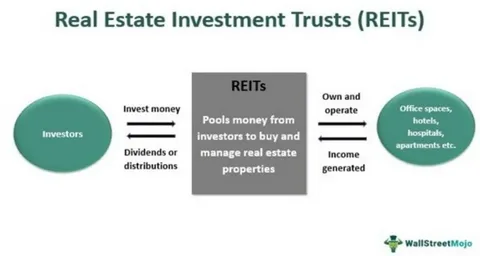

While the US has fewer traditional investment trusts (they’re more common in the UK), there are strong alternatives like REITs (Real Estate Investment Trusts) and closed-end funds. Here are some top picks:

1. Cohen & Steers Infrastructure Fund (UTF)

- Focus: Global infrastructure (utilities, pipelines, toll roads)

- Why Invest? Provides steady income with exposure to essential infrastructure assets.

- Dividend Yield: ~8%

- Keyword: Best US infrastructure investment trust

2. Nuveen Preferred & Income Opportunities Fund (JPC)

- Focus: Preferred stocks & corporate bonds

- Why Invest? High-yield income with lower volatility than equities.

- Dividend Yield: ~7.5%

- Keyword: Best US income-focused closed-end fund

3. Brookfield Real Assets Income Fund (RA)

- Focus: Real assets (real estate, infrastructure, natural resources)

- Why Invest? Diversified exposure to inflation-resistant assets.

- Dividend Yield: ~9%

- Keyword: Best US real assets investment trust

4. Adams Diversified Equity Fund (ADX)

- Focus: US large-cap stocks

- Why Invest? Tracks the S&P 500 but often trades at a discount to NAV.

- Dividend Yield: ~1.5%

- Keyword: Best US large-cap closed-end fund

5. Gabelli Dividend & Income Trust (GDV)

- Focus: Dividend-paying US & international stocks

- Why Invest? Managed by Mario Gabelli, this trust focuses on undervalued, high-quality dividend payers.

- Dividend Yield: ~5%

- Keyword: Best US dividend closed-end fund

How to Choose the Right Investment Trust

Before investing, consider these factors:

1. Investment Objective

- Growth (e.g., Scottish Mortgage)

- Income (e.g., City of London)

- Sector-specific (e.g., Greencoat UK Wind)

2. Discount/Premium to NAV

Buying at a discount can enhance returns, but a persistent discount may signal underlying issues.

3. Fees & Charges

Look for low ongoing charges (typically 0.5%-1%).

4. Track Record

Check long-term performance (5-10 years) rather than short-term gains.

5. Dividend Policy

If income is key, check dividend history and reserves.

Risks of Investment Trusts

- Market Risk: Share prices fluctuate with market conditions.

- Leverage Risk: Some trusts borrow to invest, amplifying gains and losses.

- Discount Volatility: The discount/premium can widen unexpectedly.

- Sector Concentration: Some trusts focus on niche areas, increasing risk.

Final Thoughts: Are Investment Trusts Right for You?

Investment trusts are a powerful tool for both growth and income investors. With professional management, diversification, and potential discounts to NAV, they can be an excellent addition to a starter portfolio.

Best for UK Investors:

- Growth: Scottish Mortgage (SMT)

- Income: City of London (CTY)

- Renewables: Greencoat UK Wind (UKW)

Best for US Investors:

- Infrastructure: Cohen & Steers Infrastructure (UTF)

- Dividends: Gabelli Dividend & Income (GDV)

- Real Assets: Brookfield Real Assets (RA)